Ukraine state-owned enterprises weekly — Issue 107

Editor's Note: This is issue 107 of Ukrainian State-Owned Enterprises Weekly, covering events from Oct.

14-20. The Kyiv Independent is reposting it with permission. Ukrainian SOE Weekly is an independent weekly digest based on a compilation of the most important news related to state-owned enterprises (SOEs) and state-owned banks in Ukraine.

This publication was produced with the financial support of the European Union within the project "Supporting Ukraine in rebuilding and recovery" implemented by the KSE Institute. The contents of this publication are the sole responsibility of the editorial team of the Ukrainian SOE Weekly and do not necessarily reflect the views of the European Union.

Corporate governance of SOEs

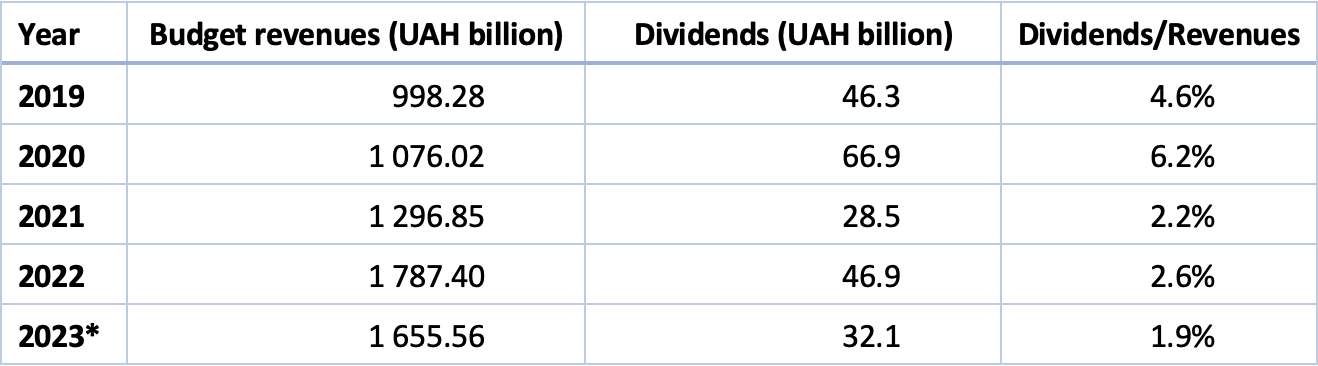

SOE dividends' contribution to state budget revenues has decreased over the past years. According to the Finance Ministry's fiscal risk statement for 2024, Ukrainian SOEs and state-owned banks' contributed Hr 46.9 billion (£1.3 billion) in dividends to the state budget in 2022. That makes up 2.6% of total state budget revenues.

We have computed the share of state budget revenues from SOEs and state-owned banks' dividends over the past five years (see below). Over this period, that share has generally decreased from 5-6% to 2-3%, constituting a minor contribution to the state budget.

* For the first eight months of 2023. Nominal budget revenues have consistently increased over the five years, initially from inflation and devaluation, and then from international help to cope with war challenges.

Despite the overall growth in nominal budget revenues, SOEs and state-owned banks' dividend payments in nominal terms have not shown a similar upward trajectory but fluctuated significantly. These fluctuations are often explained by outlier events, typically linked to either Naftogaz or PrivatBank. For example, when the state got Hr 66.9 billion (£1.8 billion) in dividends in 2020, the lion's share - Hr 39.6 billion (£1.1 billion), or 59.2% of all SOEs and state-owned banks' dividends that year - came from Naftogaz, attributed to Naftogaz receiving a £2.9 billion compensation from Gazprom following its victory in the Stockholm arbitration.

In bad years for Naftogaz, PrivatBank remains the only cash cow. For example, according to the Finance Ministry's fiscal risk statement, PrivatBank's 2022 dividends - Hr 24.2 billion (£663 million), paid in 2023 - were responsible for 75.4% of all SOEs and state-owned banks' dividends that the state budget collected in 2023. (Note that the fiscal risk statement says that this share was 80.4%. We are not aware how this calculation was made.)

Energy giant DTEK imports almost 40,000 metric tons of coal from Poland

DTEK, Ukraine's largest private energy company, has imported over 38,000 metric tons of coal from Poland, Ildar Saleyev, the company's general director, said on Oct.

20. The company plans to import 210,000 metric tons of coal for the winter to ensure the stable operation of its thermal power plants.

The Ministry of Finance plans to collect Hr 66.1 billion (£1.8 billion) in dividends in 2024 (that is, all SOEs and state-owned banks' dividends based on the 2023 financial results). That is Hr 39.8 billion (£1.1 billion) more than (or more than 2.5 times as much as) the Hr 26.3 billion (£721 million) that was planned for this year, 2023.

At the same time, the fiscal risk statement acknowledges that the amount of these dividends in 2024 will largely depend on the performance of PrivatBank in 2023, as well as its decisions regarding the write-off of non-performing loans (NPLs) associated with the former owners of the bank. We note that the profitability of SOEs and state-owned banks, and how much they pay in dividends, proved sensitive to external factors, such as public service obligations (PSOs) for state-owned companies and NPLs for state-owned banks. Russia's full-scale invasion caused shocks that adversely affected the ability of SOEs to meet dividend payments in the subsequent years.

If the state as the owner expects specific SOEs, such as PrivatBank, to serve primarily as revenue generators for the state budget, it should explicitly state this expectation in the ownership policy.

Banks

Sense Bank's acting CEO interviewed. Sense Bank's acting CEO Olena Zubchenko was interviewed this week by Forbes Ukraine. We selected the key points. On the competition to select a permanent CEO:

- "The executive search agency that will conduct the CEO competition has now been selected.

It is a reputable international company."

- "I haven't thought about applying for that competition yet. But even if I don't apply, I will remain in the top management."

In SOE Weekly's Issue 98, we reported that Sense Bank, previously owned by sanctioned Russian oligarchs Mikhail Fridman, Petr Aven, and Andrey Kosogov, was nationalized in late July. On July 23, the Individuals Deposit Guarantee Fund (DGF) appointed the supervisory and executive boards based on proposals from the Finance Ministry, with the approval of the National Bank of Ukraine.

On July 24, Sense Bank announced the start of work of the new executive and supervisory boards. See more in Issue 98. As we wrote in Issue 100, on Aug.

14, Sense Bank reported that its CEO Dmytro Kuzmin resigned for personal reasons. The deputy CEO Olena Zubchenko started temporarily acting as CEO. The supervisory board would begin selecting and appointing a new permanent CEO as soon as possible, Sense Bank then added.

On the imminent resignation of Kuzmin:

- "One day Kuzmin called me to his office. He said: "I'm not feeling well." In the end, we decided that he would rest for a few days, undergo a medical examination, and decide what to do next. Then there was a letter of resignation."

Ukrainians can now officially open stores on Etsy online marketplace

Ukrainians can now officially open stores on the Etsy online marketplace following the launch of Etsy payment system in Ukraine, Digital Transformation Minister Mykhailo Fedorov announced on Oct.

18.

Earlier, Forbes Ukraine reported that Kuzmin might resign due to health problems and the new management's "less than convincing performance" in the first weeks at the helm of the nationalized bank.

- "I don't know if there were any threats to the former CEO. As for me, I have been acting for seven weeks now, and I even walk home in the evening when I can. I have not received a single threat.

I lead a normal social life. For comparison, at PrivatBank, I used to tell people not to come to work on certain days, never to leave documents on the computer, etc., when you realize that your phone or iCloud can be hacked. There is no such thing here."

On personnel issues:

- "Everyone who wanted to leave has already left (the bank after nationalization).

People were leaving. The first team that competitors wanted to take was lawyers, then IT security, and a few people went to the National Bank."

- "But I have already realized that there are many young people here who already have good professional experience and are quick learners. For example, I was most worried about the financial area.

But there were young, proactive people who were able to collectively close all the issues."

On the bank's audit:

- "There are several audits. One of them - on related parties - has already been completed, and there are no critical comments on it. There are two companies where the situation with related parties is not fully understood.

Additional analysis is required."

- "The audit of financial and economic activities is also ongoing. It is being conducted by Ernst & Young. It takes more time.

We would like to have some preliminary conclusions by the end of the year or at least in January."

On the possible sale of the bank:

- "I don't see any substantive interest in buying the bank. I think some (prospective buyers) will be concerned about lawsuits, some about the Security Service of Ukraine, etc. From an investor's point of view, we haven't even finished a year yet, so what can we show?

We need 2023 and then another year. So, we will only be able to talk about anything in 2025."

- "The merger of Sense Bank with Oschadbank is the most fantastic story that I heard when I worked at the Finance Ministry."

Energy sector

Naftogaz pays over Hr 70 billion in taxes for the first nine months of 2023. On Oct.

18, Naftogaz Group reported that it paid over Hr 70 billion (£1.9 billion) into state and local budgets for January-September 2023. That includes Hr 5 billion (£137 million) to local budgets, and Hr 65 billion (£1.8 billion) to the state budget (representing 11.8% of the country's total tax revenues), the press release reads.

In SOE Weekly Issue 99, we reported that Naftogaz Group paid over Hr 48 billion (£1.3 billion) into state and local budgets for the first seven months (January-July 2023). As we wrote in Issue 87, Naftogaz paid Hr 33 billion (£905 billion) in taxes for the first four months (January-April 2023). Ukrenergo to receive a 76-million-euro grant from Germany to strengthen its defenses and improve the reliability of the power supply. On Oct.

13, Ukrenergo reported that it signed an agreement to receive a 76-million-euro grant from the German government through the KfW development bank. According to the company, the funds will be used to harden its substations against Russian attacks, install new high-voltage equipment, including autotransformers, and modernize the grid along the borders with other European countries. According to Ukrenergo's CEO Volodymyr Kudrytskyi, these measures will improve the reliability of power supply to consumers.

The financing will also help Ukrenergo to integrate Ukraine's and Moldova's power systems with the rest of continental Europe's.

Boryspil airport plans to resume operations within a month of war's end Ukraine's largest airport, Kyiv's Boryspil International, is prepared to resume flights within one month after the end of the war, the airport's director general Oleksiy Dubrevskyy said in an interview with Politico on Oct.

18.

Ukrenergo reported that it has already attracted more than 220 million euros in loans and grants from KfW to restore and rebuild substations. German transmission system operators Amprion, TenneT, TrasnetBW, and 50 Hertz provided more than a hundred pieces of equipment necessary for the repair of the company's trunk power grids and substations.

Ukraine expects Russia to repeat last winter's attempts to destroy parts of the energy grid with missiles and drones, weaponizing winter weather against civilians. While last year's attacks caused many blackouts, Russia was ultimately unsuccessful in bringing down the grid. In SOE Weekly Issue 94, we reported that the European Bank for Reconstruction and Development (EBRD) would provide 600 million euros to support Ukraine's energy sector - funds would go to Ukrenergo, Naftogaz, and Ukrhydroenergo.

As we also wrote in Issue 94, since Russia's full-scale invasion, Ukrenergo has attracted financial support from the EBRD in the form of loans and grants worth more than 500 million euros. About 300 million euros of that amount strengthened the company's liquidity and allowed it to make payments to market participants for 2022 and 2023.

Infrastructure

Ukrzaliznytsia's CEO Lyashchenko interviewed. Ukrzaliznytsia's CEO Yevhen Lyashchenko was interviewed by Forbes Ukraine this week. We selected the key points.

On financial results:

- "In the first six months of the year, Ukrzaliznytsia's profit was Hr 4.76 billion (£130 million)... We also made a profit in the first nine months of this year, but we still need time to settle the accounts (to name the exact number)... Ukrzaliznytsia will end the year as a profitable company."

In SOE Weekly Issue 70, we reported that on Dec.

30, 2022, the Cabinet of Ministers approved Ukrzaliznytsia's consolidated financial plan for 2023. According to that plan, Ukrzaliznytsia expected to lose Hr 20.2 billion (£554 million) in 2023 due to the large social policy burden and restrictions on cargo transportation. We also reported in Issue 72 that Ukrzaliznytsia took losses of Hr 10.8 billion (£296 million) in 2022.

The loss from passenger transportation was Hr 13.3 billion (£365 million), suggesting that the company's other segments, such as cargo transportation, made a profit of Hr 2.5 billion (£68 million).

Turkish ambassador: Black Sea grain deal possible to restore "We believe that the grain initiative can be revived... As you know, the initiative became a reality thanks to Turkey's cooperation with the UN, Ukraine, and Russia," the ambassador said in the interview.

As we wrote in Issue 80, when Deputy Prime Minister Oleksandr Kubrakov announced the appointment of Lyashchenko as Ukrzaliznytsia's new CEO in March, he said that Lyashchenko had three key tasks: to unbundle passenger transportation, cargo transportation, production, and infrastructure into separate businesses; to implement the investment program; and to break even (in terms of financial performance).

As we wrote in Issue 103, Lyashchenko said in September that Ukrzaliznytsia was breaking even and would end the first nine months of 2023 with a profit. See more in Issue 103. On transportations in January-September 2023:

- "The transportation volumes, unfortunately, did not give as big a plus as we had expected, but at least they reached a stable level."

- "We had fairly good results in the third quarter, and especially in the second quarter when the ports were working.

But when shipments through the Black Sea ports almost stopped, and problems with transit and exports through land corridors began, cargo traffic dropped significantly. We are now balancing at zero in terms of profitability."

- "In the first nine months of 2023, the volume of freight traffic decreased by 9.2% to 107 million metric tons. But our traffic structure has changed.

The volume of domestic traffic increased significantly - up to 60% in January-September. At the same time, more than a third of this is the transportation of non-grade cargo (such as crushed stone, sand, or salt), which is unprofitable for us. And this is a problem."

- "However, for the first time in many years, passenger traffic is increasing the company's profitability.

And by the way, not only international trips but also some domestic ones are now marginally profitable. For example, these are Intercity trains. We are currently working on the efficiency of route planning and maintenance costs.

Of course, passenger transportation is still unprofitable overall - we expect a minus of about Hr 15 billion (£411 million) by the end of the year. But they are also unprofitable in Europe, and this is a social policy function."

Ukrzaliznytsia's loss from passenger transportation amounted to Hr 13.3 billion (£365 million) in 2022. Practices consistent with the OECD Guidelines on Corporate Governance of SOEs imply that costs for fulfilling social policy functions should be financed directly from the state or municipal budgets rather than cross-subsidized as they are currently at Ukrzaliznytsia.

On changes to transportation tariffs:

- "This does not depend on us - we need a decision from the Cabinet of Ministers. But adjusting tariffs in line with inflation is not an increase, it is a mere indexation, and this is normal. This applies to all tariffs.

It will be discussed closer to the time when the financial plan for 2024 is ready. But I emphasize that it should be indexation, not an increase."

As we wrote in Issue 103 in September, Lyashchenko said that the company's 2024 financial plan had just been submitted and its analysis was not yet complete. See more in Issue 103.

On the connection to Poland:

- "In the first nine months of 2023, the company's profit from this area was about Hr 800 million (£22 million)."

On expanding passenger traffic with EU countries:

- "We are already doing this. And we are accustoming our passengers to normal transfer routes. This is a matter of reliability and comfort.

On Oct.

15, the company launched the Lviv - Warsaw route via Rava-Ruska station. We are already testing Chop - Prague trips with Czech RegioJet. We are also working on launching the Przemysl - Berlin trip together with RegioJet by the end of the year."

Biden all in on aid to Ukraine, yet House remains an issue

In a prime-time address from the White House, U.S.

President Joe Biden said he was going to send Congress an "urgent" funding request for aid to Ukraine and Israel on Oct.

20.

The administration will attempt to push for £105 billion in assistance to Ukraine and Israel, as the