Sanctions targeting Russian oil are falling apart. What will the West do?

A recent Washington Post investigation revealed that the US Army had been purchasing fuel produced from Russian oil through a chain of intermediaries. There is no more telling example of the ineffectiveness of sanctions against the Kremlin. Before the oil embargo was introduced, Russia had managed to redirect its commodities flow to India, Turkiye and China, hardly noticing the sanctions.

The only hope left was the price cap mechanism, which prohibits the transportation of Russian oil should its price exceed US£60 per barrel. The complicated monitoring scheme proved far from perfect, and the price cap was too high to deprive Kremlin-controlled oil companies of surplus revenues. In a matter of months, Russia had learned how to circumvent the embargo and export oil above the price cap.

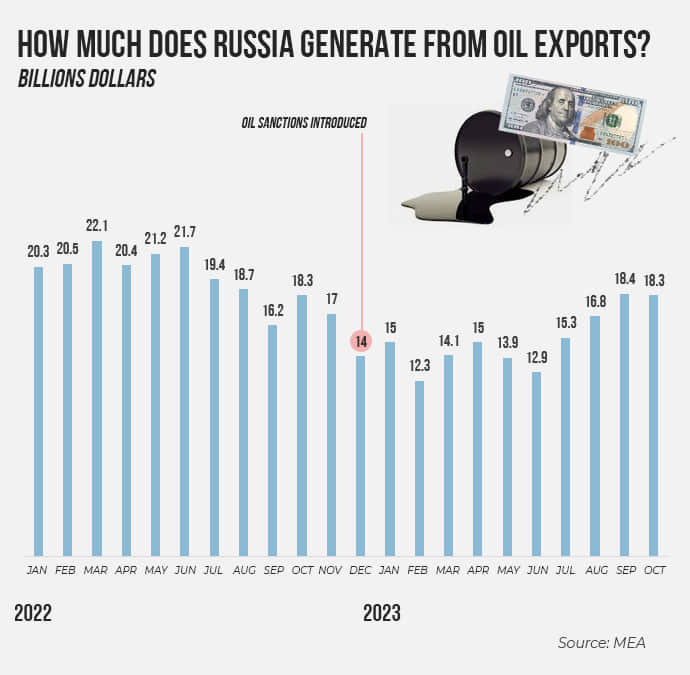

Advertisement:The result is that 99% of Russia's oil is being sold at over US£60 per barrel, production has stayed constant compared to 2021, and Russian oil revenues have stayed at the same level as in August 2022, before petroleum was subject to sanctions.

However, the system's imperfections do not mean it can't be improved. The failure of the existing sanctions has forced Western officials to take a stricter approach to Russian oil.

Why haven't oil prices fallen?

Back in 2022, there were hopes that the issue of Russia's massive profits would resolve itself. The global economy was expected to start slowing down, and oil production would remain high, causing oil prices to plummet and the Russian economy to fall like dominoes.

However, things ended up being more complicated than that. Russia promptly found a situational ally. The Organisation of the Petroleum Exporting Countries (OPEC), an oil cartel which controls 40% of global production, engineered an artificial shortage of crude oil worldwide to keep prices steadily high.

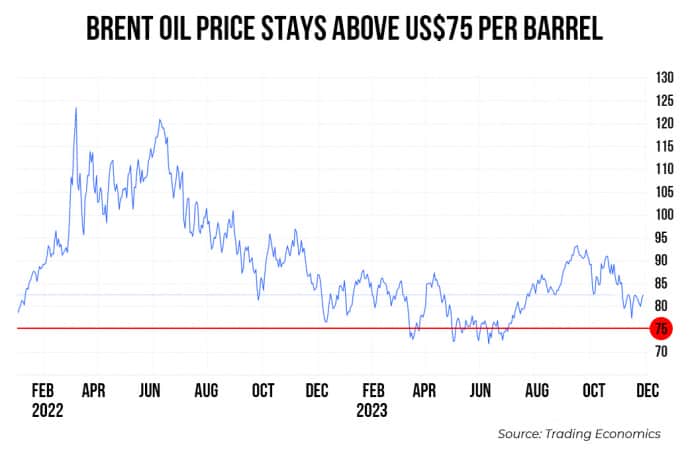

High-technology wells in Saudi Arabia and the UAE can quickly increase or decrease production. Each time the Brent Crude Oil price falls below US£80 per barrel, OPEC holds a meeting, the Arab countries report a reduction in production, and the price shoots back up.

With this scheme, Saudi Arabia has reduced production from 10.5 million barrels per day (bbl/d) to 9 million bbl/d since April alone. The country is exporting less oil, but the high prices have driven it into a budget surplus for the first time in eight years.

All the world's oil exporters, including Russia, are making huge profits. The cartel's aggressive behaviour is not just about making money. Western governments and private investors have been cutting back on their involvement in oil projects and refocusing on wind and solar energy as part of their green energy policies.

The Saudi authorities fear oil will cease to be a formidable source of influence and wealth in the coming decades. Artificially maintaining sky-high prices is an attempt to regain investor confidence and prolong the age of domination. Despite the impact high oil prices are having on the global economy, OPEC nations have repeatedly made it clear that they will not compromise their interests.

Even US President Biden has failed to convince his Arab allies to increase production. The International Energy Agency estimates that demand for oil will soon collapse due to the high prices and advocates increasing production. OPEC, however, claims that demand is stable and the market "remains balanced".

Each party tailors its forecasts to its goals. This game of ping-pong has been going on for over a year now, and there's no sign of a compromise on the horizon. Everything points to the fact that oil prices will remain moderately high.

The embargo has had some success

Russia is one of the main winners in this geopolitical game, as it receives super-profits and the opportunity to prolong the war.

The Russians earned US£230 billion from crude oil exports and US£83 billion from petroleum products in 2022. Revenues could drop by more than 20% in 2023, not necessarily because of sanctions, but rather due to falling global prices, but there will still be enough to finance the war effort. Western countries dread Russia's access to the global market being completely cut off.

Removing Russian oil from the market would push the price per barrel above US£100. That scenario could cause many countries' support for the sanctions regime to crack. The Western coalition has chosen to take a cautious approach.

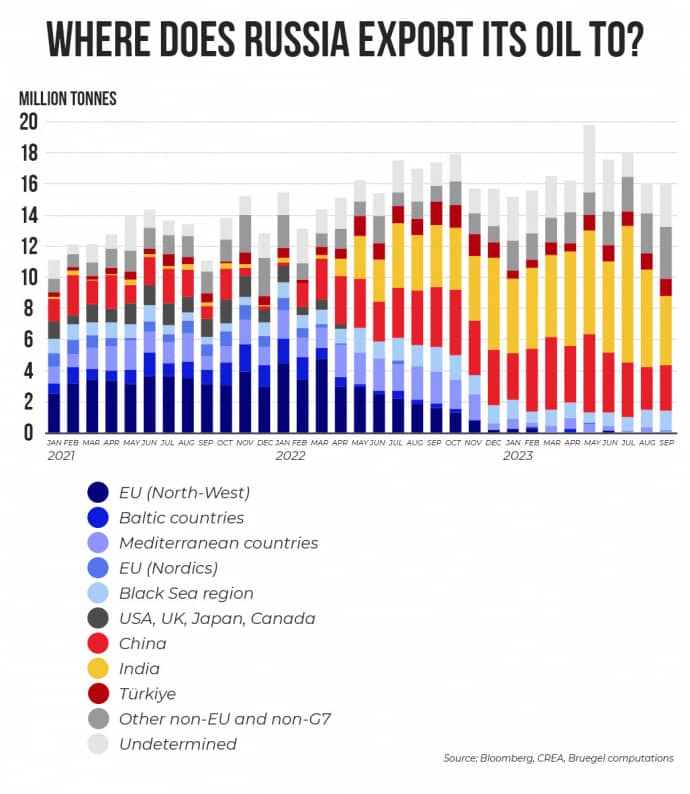

The EU and the UK banned seaborne Russian oil imports in December 2022, followed by restrictions on trade in petroleum products two months later. The ten-month delay in sanctions was necessary for EU countries to find other suppliers. The Kremlin made good use of this time and took over the Chinese, Indian and Turkish markets by offering discounts.

Eventually, the discount on Russian oil relative to Brent fell from US£35 per barrel to US£17 per barrel, and it continues to fall.

Besides, the embargo included a range of exemptions. For example, oil is still being pumped to Hungary through one of the branches of the Druzhba (Friendship) pipeline, and seaborne deliveries to refineries in Bulgaria persist. The latter managed to get an exemption on the pretext of energy security.

However, data from the Centre for Research on Energy and Clean Air (CREA) revealed that the country has begun to abuse it. Bulgaria has emerged as the largest importer of Russian oil after China, India and Turkiye. It sells the refined fuel it produces not only domestically, but also on foreign markets.

A Bulgarian refinery owned by the Russian company Lukoil exported petroleum products to the tune of EUR983 million in 2023 alone.

Petroleum products made in other countries from Russian crude oil are not subject to the embargo. For example, there is nothing to stop the United States from purchasing Indian fuel made from Russian oil.

There is a silver lining: the embargo has hit exports of Russian-manufactured fuel oil, diesel and petrol (gasoline). The Kremlin has to sell these products in Asia with a discount of up to 40%, since Chinese and Indian refineries produce enough to meet demand.

Learn more: Russia was expected to face a 30% drop in oil production and a 15% fall in GDP, yet none of this happened.

What went wrong?

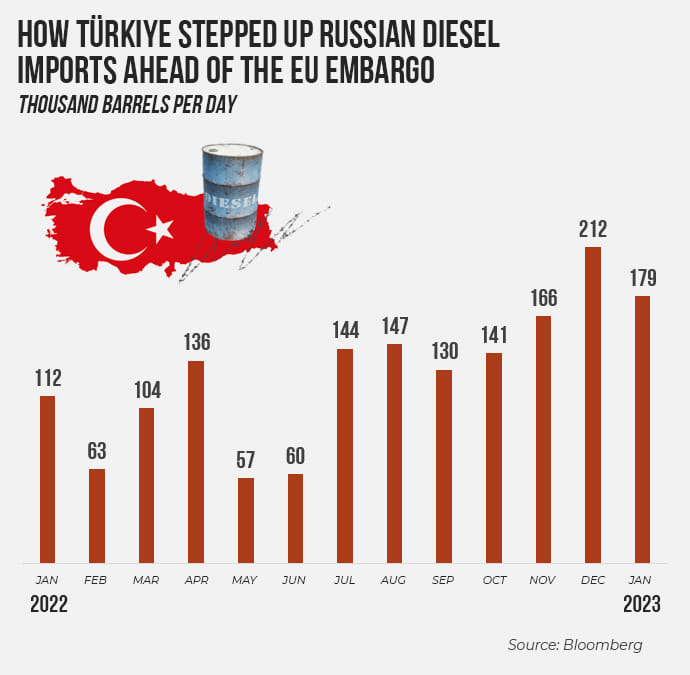

Meanwhile, Russia has managed to claw back part of the European oil market. Shortly before the sanctions were imposed, Turkiye sharply ramped up its imports of Russian fuel and simultaneously increased its exports to the European Union. This nation is now the largest buyer of Russian petroleum products.

"You can trace the origin of crude oil by its chemical composition, but it's more complicated with fuel. Turkiye can sell its domestically-produced fuel to the EU and use Russian fuel. Equally, it can just re-export what it imports from Russia.

Both cases are resale," says Borys Dodonov, an analyst at the Kyiv School of Economics (KSE).

So the embargo has destroyed the usual logistics routes by which Russian crude oil and petroleum products are exported, and it has lost the Kremlin revenue since the Russians have had to offer their customers significant discounts. But it has not dealt a knockout blow to the Putin regime.

Why aren't the oil price caps working?

At the same time as the embargo, the G7 countries introduced a price cap. This mechanism prevents Russia from selling oil at a price higher than a coalition of Western countries determines.

The cap is US£60 per barrel for crude oil and US£100 per barrel for fuel. The idea was to ban insurance for tankers carrying Russian oil purchased above the specified limits. Cutting the offenders off from maritime services is easy, given that 76% of Russian oil carriers were insured in the UK and Norway.

The restrictions functioned on a wing and a prayer. Shipping companies, brokers and traders had to keep records proving that they were paying the "correct" price for Russian oil, with insurers receiving confirmation from their clients. A shipping company can contravene the price caps for a while, but if found out, it risks facing G7 sanctions.

The system was based on the market participants' fear of being sanctioned. Until June 2023, Russian Urals oil [a brand used as a reference for pricing - ed.] was trading at US£50-55 per barrel. However, the Russians later bought up 15-year-old tankers and had them insured with their own companies or in neutral countries.

According to KSE, the share of Russian oil tankers tied to Western insurance fell from 76% to 26%. Now the G7 could only affect the transportation of a quarter of the oil shipped from Russian ports. Then Ukraine's allies lost control of the remaining 26% of tankers, as Western-insured vessels began to ignore the price cap.

The price of a barrel of oil may be US£60 on paper, but the Russians include higher logistics costs and a trade margin in their contracts. The difference between the actual logistics costs and the contractual price ends up in the pockets of Russian-controlled traders. Borys Dodonov says the rules stipulate that the price for shipping and other services must be reasonable.

However, no effective monitoring system is in place to penalise any dodgy paperwork quickly. Therefore, shipping companies no longer fear penalties, and the price caps have stopped working. Petroleum products are a different story.

Some 61% of tankers carrying Russian fuel are covered by Western insurance. However, the price caps for fuel were higher than the market prices. In other words, transporters didn't even need to come up with anything.

KSE data shows that Russian petroleum products have been sold at prices exceeding the US£100 per barrel cap for the past few months. This is likely to be the same scenario as in the case of crude oil.

How is the West responding?

In October, it became clear that the oil sanctions are in need of an overhaul. The exemptions granted to Bulgaria and Hungary will remain in place until the end of 2024.

In the meantime, these countries will build pipelines allowing them to bring in oil from Greece and Croatia. Supplies from Russia may diminish long before there is a comprehensive ban. One way to stop imports of fuel made from Russian oil is to introduce certificates of origin.

The greatest challenge is Russia's shadow tanker fleet. KSE's Dodonov believes Russian tankers should be forced to obtain Western insurance or be denied access to straits in Western countries' territorial waters.

Learn more: How Western energy sanctions against Russia are failing

The Russians transport 80% of their oil through Greece, Denmark and the English Channel. Introducing such rules would restore control over the majority of Russia's tanker fleet and could force the Kremlin to comply with the price caps.

Some 72% of Russian oil tankers are over 15 years old and at a higher risk of accident.

Small insurance companies may be unable to bear the costs in the event of an oil spill, as billions of dollars would be required to clean up the damage. This may force tankers to obtain insurance from credible Western companies.

The European Commission may propose such a measure in its 12th sanctions package.

Reintroducing Western insurance for tankers is not enough: companies must be forced to stop lying in their paperwork. Making an example of a few of the culprits will help here.

Two weeks ago, the US punished such offenders for the first time when sanctions were imposed on three UAE-based firms. These companies have been cut off from Western maritime services, and their managers face criminal prosecution. Warning letters have been sent to 30 other shipping companies owning about 100 tankers.

Bloomberg sources say the US has shifted its tone towards potential violators and is now talking explicitly about penalties. The result has been rapid. The Greek companies that received letters from the US have cut their Russian oil shipments by a quarter.

The companies are likely considering how to go on working with the Kremlin from now on. The EU needs to bring the "shadow fleet" under the jurisdiction of Western insurers, and the G7 needs to develop a mechanism to monitor transactions in the shipping market and deal promptly with any violations. The rules will only be effective once all parties are incentivised to follow them.

This article was written as part of an ANTS project entitled Russian Assets as a Source of Recovery of the Ukrainian Economy, implemented in cooperation with the National Democratic Institute (NDI) and with financial support from the National Endowment for Democracy (NED).

By Bohdan Miroshnychenko, Ekonomichna Pravda

Translation: Artem Yakymyshyn

Editing: Teresa Pearce