Ukrainian Defense Industry Enters SIPRI Top 100 Ranking

4 December, 2023 Representatives of Ukraine at the EDEX 2021 exhibition in Egypt. Photo credits: Luch DB International analysts have published an annual ranking of the world's 100 largest defense companies.

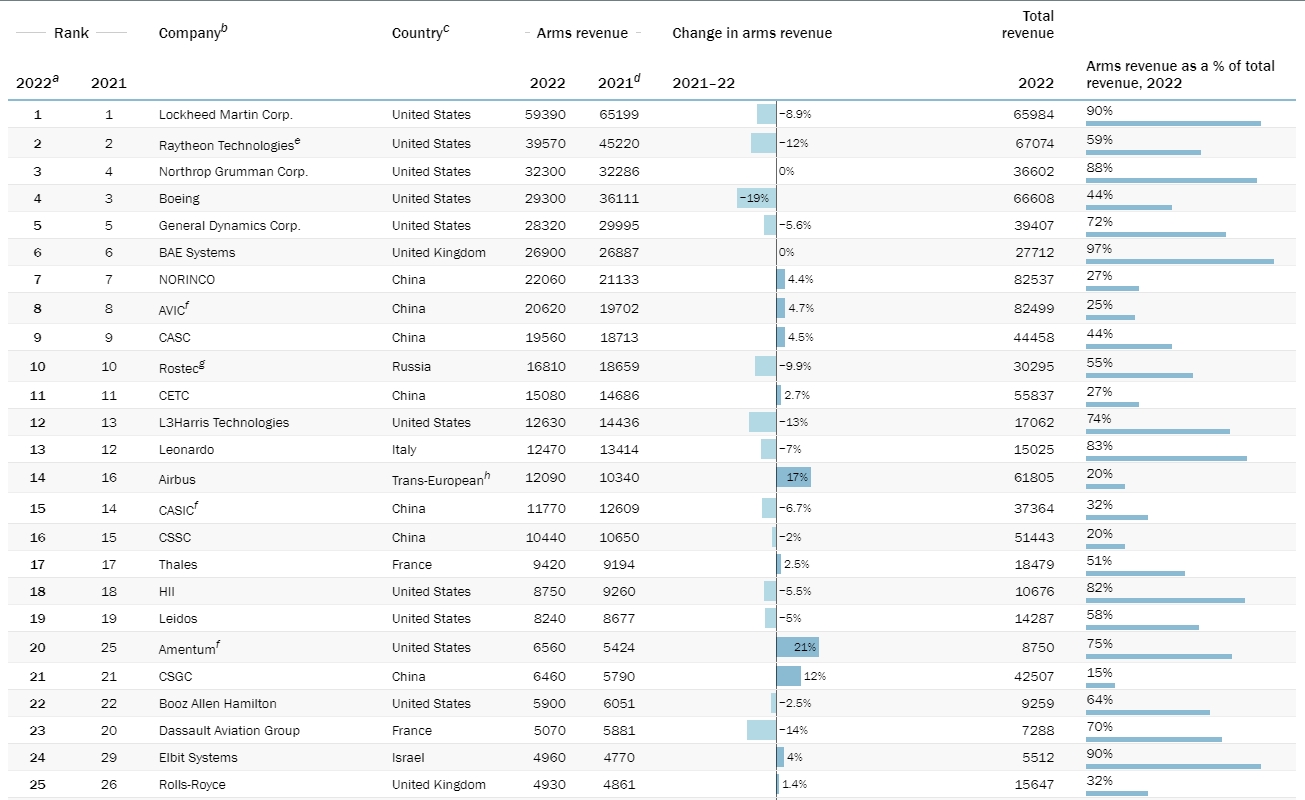

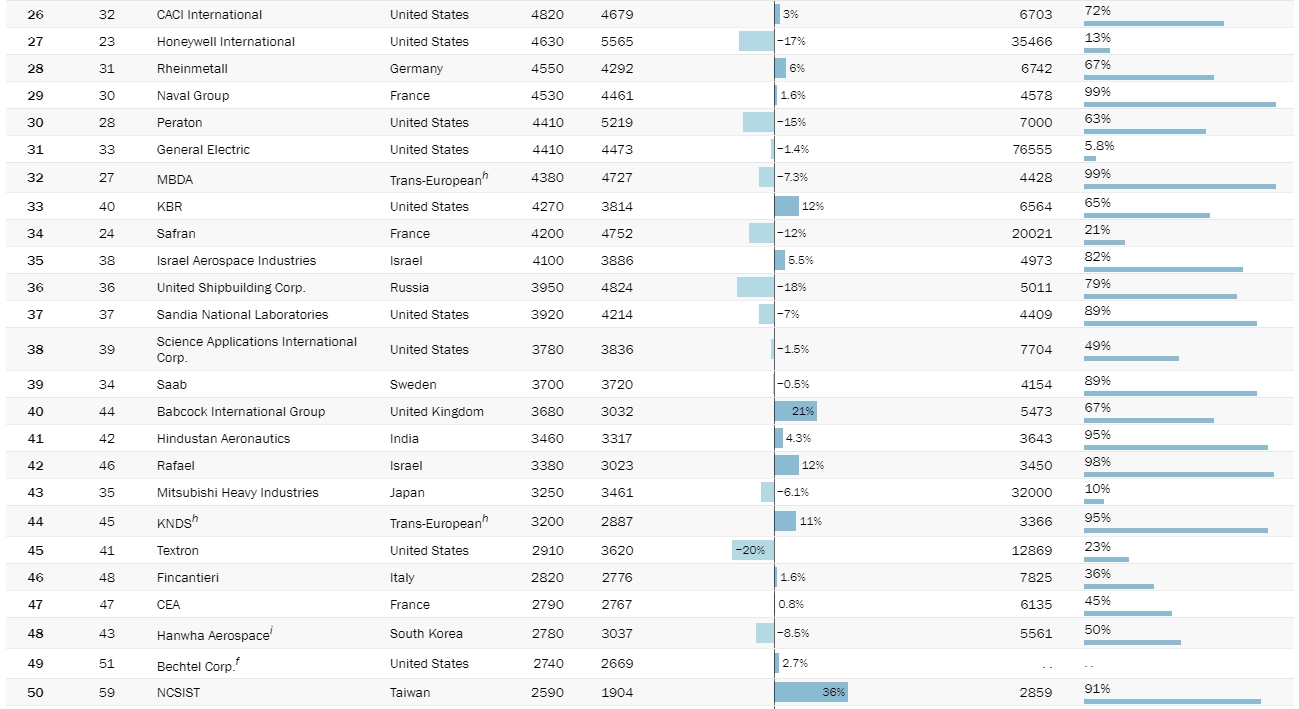

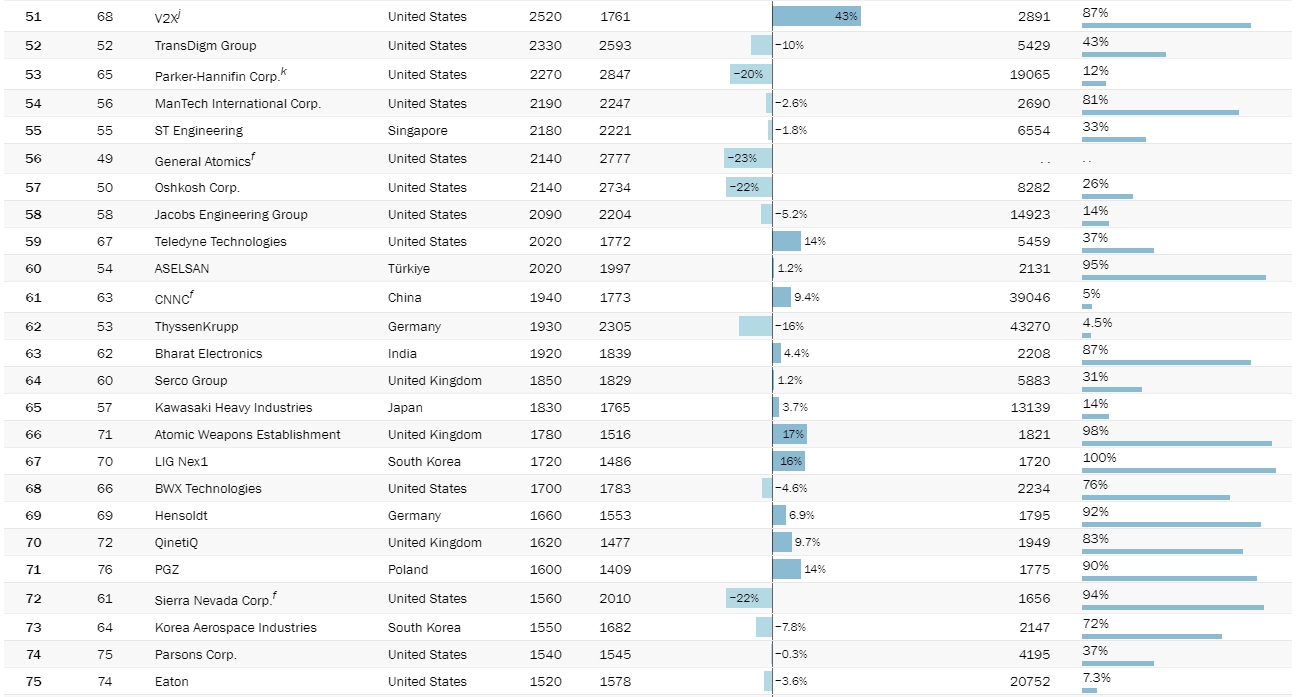

The Stockholm International Peace Research Institute (SIPRI) has analyzed the results of 2022. Revenues from sales of arms and military services by the 100 largest companies in the industry totaled £597 billion in 2022, 3.5% less than in 2021 in real terms, even as demand rose sharply, according to data released today by the Stockholm International Peace Research Institute (SIPRI). According to the institute's press release, the decrease was chiefly the result of falling arms revenues among major companies in the United States.

At the same time, revenues increased substantially in Asia, Oceania, and the Middle East.

According to the SIPRI, the Russian-Ukrainian war and geopolitical tensions around the world fuelled a strong increase in demand for weapons and military equipment in 2022. However, despite receiving new orders, many US and European arms companies could not significantly ramp up production capacity because of labor shortages, soaring costs, and supply chain disruptions. In addition, Western countries placed new orders late in the year, and the time lag between orders and production meant that the surge in demand was not reflected in these companies' 2022 revenues.

However, new contracts were signed, which could be expected to translate into higher revenue in 2023 and beyond.

Ukraine and Russia

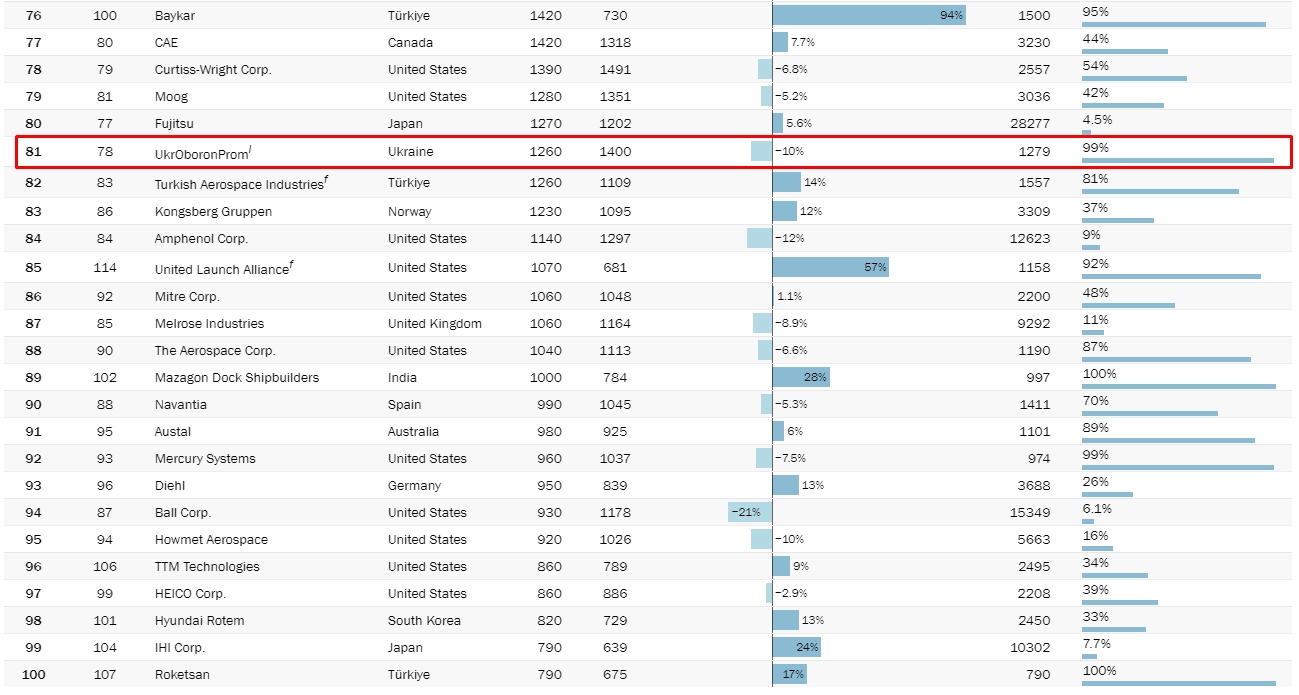

The only Ukrainian company in the Top 100, Ukroboronprom, saw a 10% real-term drop in its arms revenue to £1.3 billion.

Ukroboronprom. Illustrative image

Ukroboronprom. Illustrative image

Ukraine's defense industry was ranked 81st in the ranking. Due to a lack of data, only two Russian companies were included in the Top 100 for 2022. (Russian companies stopped publishing their production data.)

Their combined arms revenues fell by 12% to £20.8 billion. Despite being a holding entity with no direct manufacturing capacity, Rostec is included in the 2022 ranking as a proxy for the companies it controls.

Work on T-72B3 tanks in Russia. Photo credits: Rostec

Work on T-72B3 tanks in Russia. Photo credits: Rostec

According to SIPRI, Rostec ranks 10th in the ranking.

Russia's United Shipbuilding Corporation ranks 36th in the ranking.

World

The arms revenues of the 42 US companies in the Top 100 fell by 7.9% to £302 billion in 2022. They accounted for 51% of the total arms revenue of the Top 100. Of the 42 US companies, 32 recorded a fall in year-on-year arms revenue, most commonly citing ongoing supply chain issues and labor shortages stemming from the COVID-19 pandemic.

The arms revenues of the 26 companies in the Top 100 based in Europe rose by 0.9% to reach £121 billion in 2022. Trans-European companies Airbus and KNDS were among the main sources of arms revenue growth in Europe, largely due to deliveries against long-standing orders.

Photo credits: KNDS Group

Photo credits: KNDS Group

The arms revenues of the seven companies in the United Kingdom listed in the Top 100 grew by 2.6% to reach £41.8 billion, or 7.0% of the total. In 2022, China accounted for the second largest share of combined Top 100 arms revenues by country, at 18%.

The aggregate arms revenues of the eight Chinese arms companies in the ranking increased by 2.7% to £108 billion.