Sanctions for show: Russian oil sales to China, India single main driver of Ukraine invasion

As Western sanctions designed to cripple Russian energy exports barely slow them down, the Kremlin continues to make enough money to keep its war against Ukraine going indefinitely, just by selling oil to China and India. After pivoting away from Europe, Moscow found enthusiastic buyers in Beijing and New Delhi. By exploiting loopholes, Western reluctance to crack down, and a shadow fleet of decrepit oil tankers, Russia was projected to make around £180 billion from oil exports in 2023, compared to £110 billion in 2021.

The earnings are Moscow's single greatest financial lifeline and the main driver of the full-scale invasion. A U.S. defense official told Reuters in mid-February that Moscow has spent £211 billion on the war since February 2022. Oil money pays for weapons, ammunition, and high enlistment bonuses that keep the army topped up with 25,000 men per month to replace the 20,000 it loses on average in its war against Ukraine, according to Viktor Kevliuk, a military expert with the Center for Defense Strategies.

With steady oil production and much of the Russian economy retooled for total war, this pattern is set to continue, likely resulting in the attrition of Ukraine's Armed Forces and the country requiring even more weapons from allies over time. Moscow has been able to boost revenues largely because Western sanctions on the Russian energy sector are shortsighted, full of loopholes, and there is a lack of enthusiasm to enforce them, according to expert interviews and analysis by the Kyiv Independent.

Delegates look on as Russian President Vladimir Putin delivers a speech at a meeting during the closing day of the BRICS summit at the Sandton Convention Center in the Sandton district of Johannesburg on Aug.

Delegates look on as Russian President Vladimir Putin delivers a speech at a meeting during the closing day of the BRICS summit at the Sandton Convention Center in the Sandton district of Johannesburg on Aug.

24, 2023. (Per-Anders Pettersson/Getty Images)

Western attempts to set oil price caps on Russian exports have only succeeded in pushing Russia further out of reach of international financial controls. The Kremlin has also profited from China and India's fuel hunger.

India is using Russian oil to fuel its development, even refining some and selling it back to the West. For China, Russia has passed Saudi Arabia as the top supplier. For the sanctions to work, they need a broader reach and better tracking and targeting of violators, on top of stronger enforcement, experts say.

That includes putting more people on the problem, requiring more stringent insurance compliance, closing loopholes, and blocking port access to ships that run afoul. Until these improvements happen, Russian President Vladimir Putin will continue to use every available effort to fund his war machine. He cannot afford to do otherwise, said Bringham McCown, senior fellow and director of the Initiative on American Energy Security at the D.C.-based Hudson Institute.

"He's playing every card that he has and I think the West has been somewhat naive in understanding this," McCown said.

Pivot to Asia

Several experts estimate that hydrocarbon exports account for more than half of Russia's state revenue. McCown said that about 80% of revenue is derived from total energy sales abroad, the majority of which is oil. Elina Ribakova, an economist at the D.C.-based think tank Peterson Institute, said that oil is "important beyond belief" for Russia-- it and gas used to account for 35% of state revenue in the best of years; in 2023 it was 60%.

Until the full-scale invasion, many EU states depended on Russia for natural gas. They had to scramble for an alternative when Russia cut supplies in 2021 and 2022 and the never-used Nord Stream 2 was later sabotaged beyond repair in September 2022. As a result, EU countries shifted towards using more liquefied natural gas (LNG).

The EU was set to import record volumes of liquified natural gas (LNG) from Russia in 2023, with Belgium and Spain the second and third biggest buyers after China, the NGO Global Witness said in late August 2023.

EU adopts 13th package of Russia sanctions The package targets an additional 106 individuals and 88 entities involved in Russia's aggression against Ukraine. The list includes includes companies from India, Sri Lanka, China, Serbia, Kazakhstan, Thailand, and Turkey.

"We're seeing an uptick in the amount of LNG cargoes from the Russian Federation that the European Union is taking," said Benjamin Schmitt, a senior fellow at the University of Pennsylvania.

"So this is kind of moving the needle from pipeline to LNG cargo fungibility and that's something that is concerning as well. And again, it goes to Putin's coffers and is something that has got to stop." After the start of the invasion in 2022, there was a flurry of measures like an oil embargo from Washington and sanctions from Brussels.

Most notable was a price cap on Russian oil by the G7 states, the EU, and Australia in December 2022. Russia's exports fell at first. But with the pivot to China and India in 2023, they bounced back stronger.

Russia likely fell a tad short of the 250 million tons of crude oil exports projected in 2023, but it's still more than the 230 million tons exported in 2021.

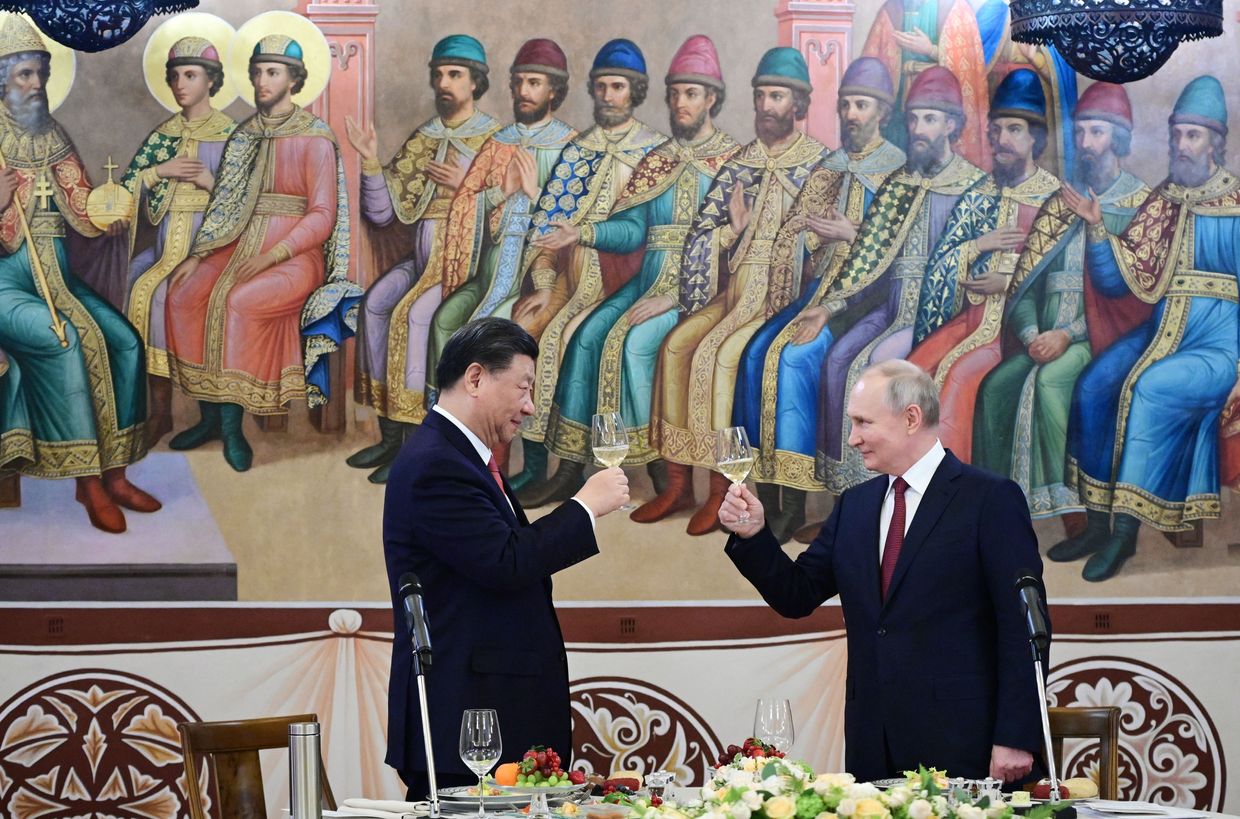

Russian President Vladimir Putin and China's President Xi Jinping make a toast during a reception following their talks at the Kremlin in Moscow on March 21, 2023. (Pavel Byrkin/AFP via Getty Images)

Russian President Vladimir Putin and China's President Xi Jinping make a toast during a reception following their talks at the Kremlin in Moscow on March 21, 2023. (Pavel Byrkin/AFP via Getty Images)

Over the two years of invasion, the share of Russia's oil in India's total imports went from 2% to 10%; in China's, it went from 15% to 19%. Schmitt said Russia has now reoriented to those markets. India, which tries to play well with both Russia and the West, is in the market for cheap oil no matter where it comes from, some of which is then refined in India and re-exported back to the U.S. and EU.

India was the second-fastest growing refined oil product exporter in 2022. Between January 2022 and April, its exports of refined products to the EU grew by 572%. In September, its diesel flows to Europe had hit a new peak of up to 303,000 barrels per day, half of the EU's total.

"Of course, it's Russian oil that everybody's buying," McCown said. In China's case, the relationship goes beyond oil. The much weaker Russia, whose economy has been shrinking for years, is drifting closer to becoming a dependent junior ally of Beijing, according to McCown.

Russia has "certainly passed the halfway point" along that journey, he said. Russia uses its oil revenue to push a narrative that Western sanctions don't work or matter and may as well be lifted. Analysts said that's far from the truth -- the sanctions will work if the allies actually put some effort into them.

"They clearly matter, but only if they're enforced," Schmitt said.

Fixing sanctions' shortcomings

Western sanctions have had issues from the start. Aside from multiple loopholes and carve-outs, they were designed with the intent to keep Russian oil on the market. Washington's very real power to target critical pressure points of the international financial system, such as banks that do dollar transactions, made it worry about going too far with hydrocarbon sanctions, Ribakova said.

The U.S. has a lot less leverage over pressure points of the global oil market, however. The U.S. and the EU considered an embargo by Europe, Russia's top hydrocarbon market at the time, but worried it would make oil prices spike dangerously during a global economic slowdown and high inflation.

People rally to support the Ukrainian people and Ukraine's sovereignty and stop Russia's war in St. Paul, Minnesota. (Michael Siluk/UCG/Universal Images Group via Getty Images)

People rally to support the Ukrainian people and Ukraine's sovereignty and stop Russia's war in St. Paul, Minnesota. (Michael Siluk/UCG/Universal Images Group via Getty Images)

Instead, they banned shipping and insurance providers from servicing Russian companies moving oil above £60 per barrel.

The majority of companies that provide such services to Russia are based in G7 and EU countries. The problem was, the targeted grades of oil were already trading for well below £60 a barrel. The EU and partners said they would update that number and bring it closer to the marginal cost of production in the £20 to £30 range but they haven't done so, Schmitt said.

"It's unfortunate. The G7, EU, and the U.S. especially pushed to keep Russian oil on the market to keep global liquidity up, but at the same time, that means that there's not as much of an impact on reducing Russian exports," Schmitt said. "You can't have your cake and eat it too." In addition, insurance companies rarely verify shipping contracts to make sure the cargo is actually priced below £60.

Few entities have been sanctioned in connection to the price cap, as authorities don't put much effort into enforcement.

Europe still hooked on Russian gas despite deep cut Russia's war in Ukraine was a watershed moment for Europe. Following Russia's full-scale invasion of Ukraine, which has killed tens of thousands and forced millions out of the country, Russia sought to punish the European Union for supporting Kyiv.

Russia began to choke Europe, violating pre-exist...

"Geopolitics are at play, people are only willing to go so far," McCown said. "Externally, this looks good. We can say we're all doing the right things, but most people know it's not effective." Many of these people "seem to be okay with that." Others just don't think that far ahead. "An important European Minister... (was) very proud of the fact of Western sanctions, but I said look, that's great.

But all that's really happened is Western Europe is paying more for oil," McCown continued. "And you are literally subsidizing China and India receiving this product," who do so by skirting sanctions. To feed this demand, Russia relies on ships from Baltic and Black Sea ports, as most of its pipeline infrastructure points west. To deal with Western restrictions, Russia put together a "shadow fleet" largely made up of old ships not supported by insurance from any coalition country, though McCown observed that many of the ships appear to be of EU or G7 origin.

This fleet transports over 70% of Russia's crude oil and a good chunk of condensates, almost all of it going to Asian markets, according to a report by the Kyiv School of Economics. Unlike Russia's more "legitimate" ships that have recognized insurance, the shadow fleet isn't concerned about the Western price cap. "The U.S.

Treasury says, okay fine at least Russia spends £10 billion to buy itself a fleet, which is £10 billion not spent on war," Ribakova said. "But this also means that Russian oil is now beyond the reach of the G7 countries' attempts to enforce the oil price cap."

A view from Russian oil company Tatneft in Tatarstan, Russia, on June 4, 2023. (Alexander Manzyuk/Anadolu Agency via Getty Images)

A view from Russian oil company Tatneft in Tatarstan, Russia, on June 4, 2023. (Alexander Manzyuk/Anadolu Agency via Getty Images)

These vessels often have convoluted ownership, skimp on insurance despite nearing the end of their 15-year lifespan, turn off their transponders, and transfer cargo to other vessels in the middle of the water. This makes buyers and sellers harder to track and subject to crackdowns. It also makes them a collision hazard for other ships and an ecological threat to every body of water they pass through.

Improving sanctions

Ecological security is one area to crack down on, Ribakova said.

Oil spills take many billions of dollars to clean up and countries can force all carriers to have insurance from reputable firms to access their ports that cover spillage liability. Port access restrictions can also be used to target specific ships, with a threat of secondary sanctions to create a compliance incentive for third-party ports. "They would have to think: Should we allow this dodgy company with this dodgy vessel to enter our port with poor insurance or are we undermining sanctions?" Schmitt said.

But this would take time and require countries to work together. Closing loopholes is crucial. For example, guidance issued by the U.S.

Treasury Department on Nov.

22 shields U.S. maritime service providers from secondary sanctions should one of their suppliers provide false claims of compliance with the price cap. The U.S. and the EU could also build larger teams to physically do the enforcement and tracking work, as monitoring Russian evasion attempts requires a great deal of effort and man-hours. Efforts are also being made to strengthen the attestation process for insurance.

Analysts said that a closure of the Black Sea to violating vessels by Turkey would be effective at curtailing exports from Novorossiysk, one of the largest ports in the Black Sea. While Turkey buys Russian oil, it has recently slowed down ships passing through the Bosphorus Strait, due to inspections for Russian crude exports.

The fire at the Klintsy oil depot in Russia's Bryansk region caused by a an alleged Ukrainian drone attack early on Jan.

The fire at the Klintsy oil depot in Russia's Bryansk region caused by a an alleged Ukrainian drone attack early on Jan.

19, 2024. (Alexander Bogomaz/Telegram)

Ukraine's recent attacks on hydrocarbon infrastructure at Russian ports may have a similar effect if they continue. "This is extremely important because Russia has completely retooled into a war economy, and foreign revenues are helping it do that," Ribakova said.

"It's important to remind people that sanctions are not an abstract concept -- it's common sense. If we give support to Ukraine, why are we letting Russia build more machinery?"

As sanctions bite, Russia eyes Ukraine's mineral resources to fund its invasion Russia's 2024 federal budget brought little in the way of surprises, the country is gearing up for a long war.

Signed by President Vladimir Putin earlier this week, it ushered record levels of military spending -- a sign of Moscow's commitment to its war against Ukraine.

While part of the Russian