Raiffeisenbank helped Putin's oligarch to get his business out of sanctions. How to prevent Russia from unblocking assets?

Two years ago, by imposing sanctions on Kremlin supporters, Western countries blocked Russian assets worth more than £500 billion.

80% of them in the form of securities, bank accounts, corporate rights, luxury real estate and luxury goods were in the European Union. At the beginning of the great war, Western partners threatened Putin: if Moscow did not stop violating international law, its blocked assets would be confiscated. However, over time, these statements turned into protracted discussions about how to dispose of immobilized assets without confiscating them.

Russia took advantage of the indecision of Western politicians and unblocked some of the foreign currency assets worth more than £100 billion. The mechanism of real financial responsibility of the aggressor state could have been crucial in closing the Pandora's Box from which the Kremlin released the war's spoils, but this did not happen.

Advertisement:Now it is important to prevent the unblocking of other assets of the Russian Federation and Russian oligarchs under sanctions. The latter are looking for loopholes to return assets blocked in the West. The recent agreement between the Raiffeisenbank group and Oleg Deripaska, an aluminum king close to Putin, confirms this once again.

Schemes to withdraw assets from sanctions must be disclosed to prevent their reappearance in the future and to punish those involved in the violation.

Reference. Sanctions have not stopped Russia's military aggression, which has caused Ukraine £650 billion in losses. This amount includes £486 billion in losses since February 24, 2022, £106 billion from February 19, 2014 to February 23, 2022, and more than £60 billion in losses caused by the annexation of parts of Donetsk and Luhansk regions.

How Austrians helped Deripaska to withdraw assets from sanctions

Raiffeisen Bank, with assets of RUB 1.987 trillion and equity of RUB 446.7 billion, was ranked fourth after VTB, Rosbank and Sberbank in the Russian Forbes rating of the 100 most reliable banks in Russia published on March 21. The publication states: "Having overcome serious problems in 2022, Russian banks showed outstanding financial results in 2023." However, the Raiffeisen Bank's website does not contain a single word about the achievements.

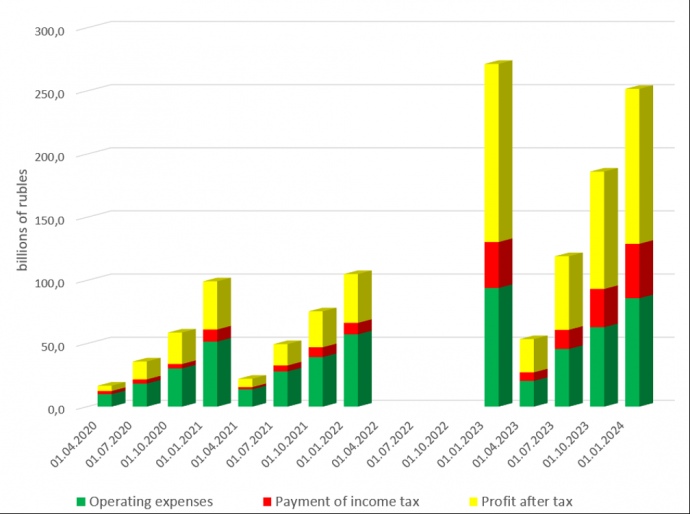

Nor is there any financial reporting. But this reporting was published by the Central Bank of the Russian Federation. It shows a significant increase in the financial activities of the Russian Raiffeisen Bank in 2022-2023 compared to 2020-2021.

Dynamics of Raiffeisenbank's financial results in 2020-2023

In particular, over the past two years, the bank, which is part of the Austrian group of the same name, has transferred RUB 79.5 billion in income tax to the Russian federal budget.

This is four times more than in 2020-2021. Shareholders of Raiffeisen Bank International (RBI) approved the financial report at the annual general meeting on April 4. According to the report, the group's net profit in 2023 amounted to EUR 2.4 billion, of which EUR 1.3 billion came from the Russian subsidiary.

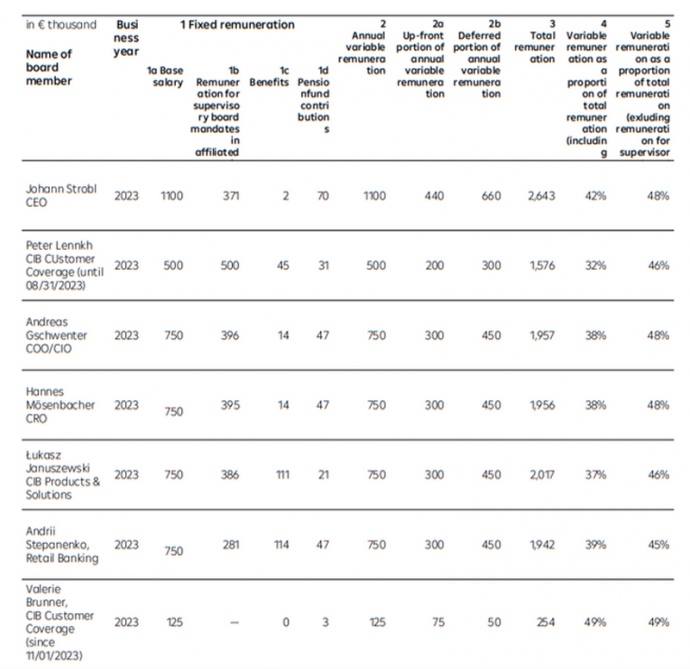

This resulted in good dividends for owners and generous remuneration for managers.

Remuneration of RBI's Management Board members for the financial year 2023 (in thousands of euros)

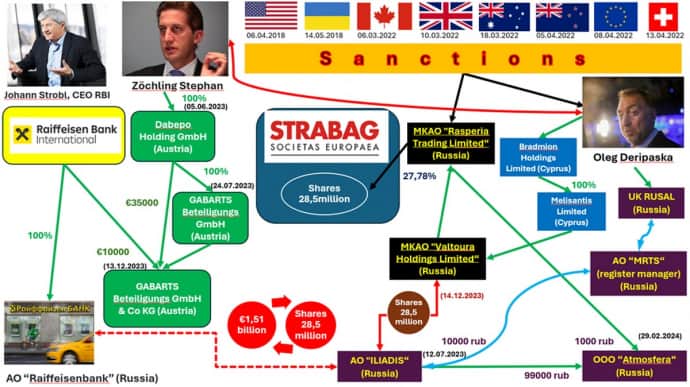

The income of Austrians in Russia is not surprising. Recently, a scandal erupted around RBI: the sanctioned oligarch Oleg Deripaska tried to gain access to the frozen 1.5 billion euros with the help of the group. Raiffeisenbank wanted to buy more than 28 million shares in the Austrian construction group Strabag SE from a Deripaska-related company.

"After the deal closes, our Russian network bank will transfer the Strabag shares to RBI as dividends in kind and thus transfer assets from Russia to Austria. With this transaction, we are achieving a significant reduction in the capital position of our Russian network bank and thus a corresponding reduction in the risk of our Russian business," explained RBI CEO Johann Strobl in the 2023 report. The group abandoned the deal after the US Treasury Department became aware of the scheme.

According to Reuters, Austrian officials also warned financiers about the inadmissibility of such transactions. "During recent exchanges with the relevant authorities, RBI was unable to achieve the necessary comfort to proceed with the proposed transaction. Out of an abundance of caution, the bank has decided to withdraw from the transaction," RBI said on May 8. A study of the state registers of Austria, Cyprus and Russia revealed what the scheme to unlock the assets of the Austrian construction company Strabag SE, which is under Deripaska's sanctions, could have looked like.

If this scheme had been completed, each of its participants would have received significant economic benefits.

The bank's announcement of December 19, 2023 stated: "After closing, RBI will retain the shares in STRABAG SE as a long-term equity participation which will be contributed to and managed by its fully consolidated subsidiary GABARTS Beteiligungs GmbH & Co KG". A company with a similar name, Gabarts Beteiligungs GmbH, was founded by Vienna-based investment banker Stefan Zochling. In June 2023, he registered the company Dabepo Holding GmbH, which founded Gabarts Beteiligungs GmbH a month later.

In December 2023, Gabarts Beteiligungs GmbH & Co KG was registered as a limited partnership, with Dabepo Holding GmbH as a shareholder (contribution of EUR 35 thousand), Raiffeisen Bank International AG as a limited partner (EUR 10 thousand), and Gabarts Beteiligungs GmbH as an unlimited partner. All three companies are located in Vienna at Kroissberggasse 13 and are solely managed by Zochling. They were all established with the same purpose: to take over Deripaska's sanctioned assets.

Zochling has long known Deripaska. Since January 2014, he has been a member of the board of the Basic Element conglomerate's Transstroy construction division, which built the Olympic Village, roads and tunnels in Sochi. In November 2021, the Austrian was appointed president of the Mykolaiv Alumina Plant.

How Deripaska became a co-owner of the Strabag construction holding

Oleg Deripaska is ranked 51st (£2.8 billion) in the ranking of Russian billionaires.

This probably does not reflect the true economic power of the pro-Kremlin oligarch, who in 2008 was ranked ninth in the global billionaire ranking with a net worth of £28 billion. Hundreds of companies of various legal forms and jurisdictions conceal his direct involvement in businesses in many fields and his property in Austria, the UK, Italy, Luxembourg, Montenegro, the US, France, and Cyprus. For example, Deripaska's ultimate beneficial ownership of a stake in Strabag SE was organized through a "nesting doll" - the Cypriot companies Bradmion Holdings Limited, Melisantis Limited, Valtoura Holdings Limited and Rasperia Trading Limited.

After being included in the US sanctions lists, Deripaska replaced the offshore firms with companies with similar names established in Russia. In particular, Valtoura Holdings Limited and Rasperia Trading Limited were replaced by MKAO Valtoura Holdings Limited and MKAO Rasperia Trading Limited registered in Kaliningrad.

"Safe havens" for blood money. Why are Russia's assets not being seized in the West?

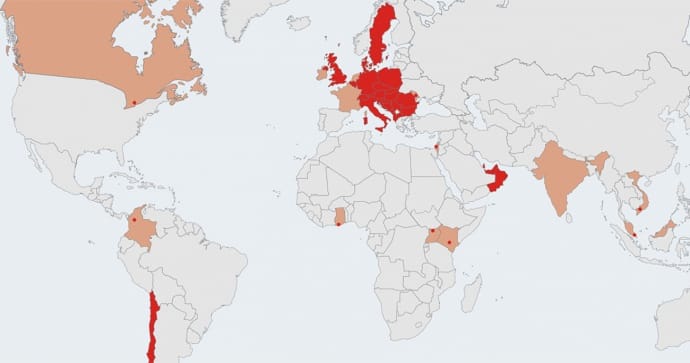

Strabag SE is one of the largest European construction groups. Its main shareholders are the Haselsteiner Group and Raiffeisen Holding. In April 2007, they sold a part of Strabag SE shares to Cyprus-based Rasperia Trading Limited.

In 2014, after receiving major subcontracts for the construction of the Olympic Village in Sochi and luxury real estate in Moscow, Strabag SE shareholders allowed the Russian to increase its stake to 25%+1 share. After sanctions were imposed and assets were blocked in the West, Deripaska tried to alienate these shares, in particular through a syndicate deal involving the Haselsteiner fund, UNIQA and Raiffeisen Group. However, the management of Strabag SE, in accordance with the EU sanctions decisions, stopped these attempts by restricting all rights of Rasperia Trading Limited related to the shares, including the right to vote and receive dividends, and withdrew from construction projects in Russia from April 2022.

Moreover, on June 24, 2022, and June 16, 2023, Strabag SE shareholders decided not to pay the Russian company EUR 41.3 million in dividends for 2022 and EUR 180 million for 2023, reducing the share of Rasperia Trading Limited to 24.11% and thus depriving Deripaska of the right to block the decision.

Geography of projects of the Strabag SE construction group

Source: STRABAG.COM

Source: STRABAG.COM

Russians are testing new "red lines"

The scheme was nearing completion. In March 2024, the ownership of 28.5 million shares of Strabag SE, which belonged to the Russian company Raspberia Trading Limited, was transferred to the newly created AO "Iliadis" in accordance with the purchase and sale agreement between Iliadis and Valtura Holdings Limited (Kaliningrad) concluded on December 14, 2023. However, a sharp warning from the US Treasury Department and close attention from the US sanctions agency OFAC warned the RBI against acquiring the shares.

This story has a positive interim outcome. The red lines have not been crossed.

Otherwise, this precedent could provide grounds for unblocking all assets of legal entities and individuals on the sanctions lists.

What will prevent the Central Bank of Russia from unblocking £300 billion worth of assets? It can sell US, Canadian, French, Australian, or UK government bonds to companies that are not on the sanctions lists from its blocked reserves in small packages.

Do Western countries have mechanisms to prevent such scenarios? Russia will attract Western experts who are willing to help the Kremlin for large fees, despite the deaths and destruction caused by the actions of its leaders. The example of Zochling and Raiffeisen confirms this.

How Western companies clinging to Russia are losing markets, business, and reputation" If the plan had been implemented, this precedent could have provided grounds for unblocking all assets of legal entities and individuals on the sanctions lists. What, then, would prevent the Central Bank of Russia from unblocking about £300 billion worth of reserves located in Western countries?

For example, the Central Bank of the Russian Federation could alienate from Russia's reserves in small packages government bonds of the United States, Canada, France, Australia or the United Kingdom to a number of unremarkable Russian companies that are not on the sanctions lists, and then these companies would turn to the financial (depository) institutions where these securities are kept with a demand for funds. Do Western countries have any real mechanisms to prevent such and other scenarios of unblocking individuals' assets? Russia will engage Western experts who are willing to help the Kremlin for large fees, despite the deaths and destruction caused by the actions of its leaders.

The example of Stefan Zochling and Raiffeisenbank confirms this. As you know, on March 23, 2023, the NACP added Raiffeisen Bank International to the list of international war sponsors. This status could not have any legal consequences for the Austrians, except for reputational losses.

What did the bank do? Instead of constructively cooperating with the Austrian government to attract assistance to withdraw its investments from Russia, Raiffeisen focused all its efforts on suspending its status as an international war sponsor on the NACP portal. Ukraine has legal mechanisms and can confiscate the assets of the Russian Raiffeisen Bank, which has paid significant amounts of taxes to the Russian budget, through the courts.

According to the law "On Sanctions" the Ministry of Justice can seize assets belonging to a legal entity. However, it does not want to aggravate the situation of the RBI, hoping for a constructive understanding with its colleagues in the Austrian government.

Financial countermeasures against the aggressor

The story of the Austrian participants in the scheme to unblock the assets of an odious pro-Kremlin oligarch still needs to be carefully analyzed. The Austrian government should change its approach to helping the RBI management with the withdrawal of its subsidiary from Russia by applying countermeasures, the arsenal of which can be developed in cooperation with the governments of the United States, the United Kingdom, the EU and Ukraine.

It is up to European politicians to create legislative mechanisms that can protect Western companies with countermeasures when their subsidiaries leave Russia. Laws on the confiscation of assets of persons under sanctions should become effective safeguards against the Kremlin's continued arbitrariness. Western countries have £1,547.1 billion worth of Russian assets on their territory, which is 2.3 times more than investments in the Russian economy.

This significant surplus gives them a chance to successfully confront the aggressor financially. Austria's investment relations with Russia are also encouraging: there are 24.03 billion euros of Russian assets in Austria, which is 4.4 times more than Austrian assets in Russia. In total, there may be much more assets, as not all the wealth of odious Russians is reflected in official statistics.

If government agencies are unable to identify such assets, then non-governmental organizations and investigative activists who want to contribute to the victory over the aggressor country should be involved.

Yaroslav Sydorovych, Oksana Yurynets, Doctor of Economics, Professor, European Cooperation Agency