“Safe harbours” for blood money. Why are Russia's assets not being seized in the West?

The G7 countries have not managed yet to seize Russian money for Ukraine's recovery. There is a possibility that the funds will return to Moscow after the war. The Central Bank of the Russian Federation has more than US£300 billion in Western accounts.

These funds are a real opportunity to make the state sponsor of terrorism pay for war crimes and destroyed Ukrainian cities. It is the second year of the full-scale war, and Ukraine's allies have not only failed to seize this money but have not yet disclosed where it even is.

The freezing of such reserves was supposed to be the most powerful sanctions blow, but the aggressor hardly noticed it thanks to years of preparing for war. The allies cannot take away private assets either - the Kremlin oligarchs are avoiding responsibility by using professional lawyers and loopholes in Western laws.

Instead of directing Russian money to Ukraine for recovery right now, it is lying in bank accounts and quietly waiting for the war to end to return to Moscow.

Russia was ready

Western sanctions imposed after the annexation of Crimea in 2014 did not become a sentence for Russians but rather was a vaccine shot. They were not enough to trigger a financial crisis in Russia, but they were enough to make the Kremlin aware of the threat of new economic restrictions. The Russian Central Bank and the Ministry of Finance had been accumulating money and transferring it to a safe place.

In eight years, Russia's international reserves have grown from US£385 billion to US£630 billion. Indeed, this money was not stored in suitcases. The Central Bank invested it in foreign currency assets abroad: Eurobonds, US Treasury securities, gold and deposits.

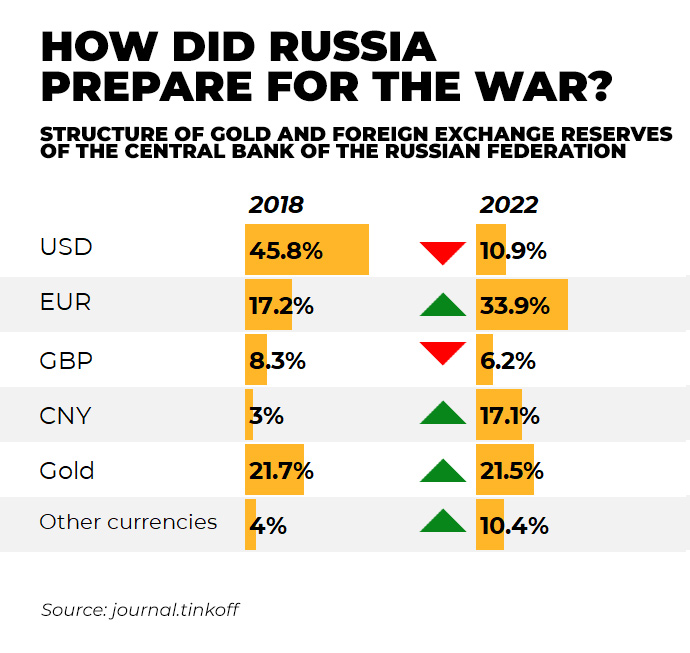

Realising that all this could be seized, Russia reduced the share of its assets in US dollars and British pounds from 2017 to 2022. While in early 2014, Russia's reserves included US£150 billion worth of highly liquid US Treasury bonds, eight years later, it had only US£5 billion left. Instead, the share of assets in euros and yuan increased.

In other words, the Kremlin was preparing for sanctions from the United States and the United Kingdom, but not from China and the European Union.

The bet on EU passivity did not work.

After 24 February 2022, the reserves of the Russian Central Bank were frozen in all Western countries. However, even when the world's largest number of sanctions were imposed on Russia in the first months of the full-scale war, the Kremlin had enough money to keep its economy from collapsing. In nine months, only 15% of the available US£630 billion was spent to support the rouble.

However, they had even this money paid off, as Western countries continued to buy Russian oil and gas. In addition, the Central Bank of the Russian Federation keeps a fifth of its reserves in gold, which can be converted into foreign currency if necessary. Nataliia Shapoval, head of the KSE Institute, has said that Russia can sell gold for US dollars or euros using their bank accounts in "neutral" countries.

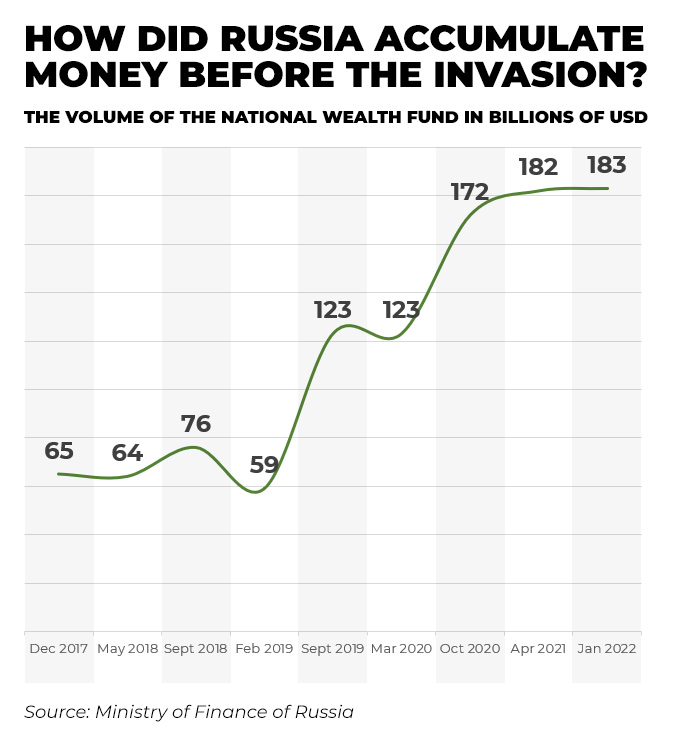

The Russian National Wealth Fund (NWF), which is the wallet of Putin's war, is also helping the Kremlin to survive. It is from its accounts specifically that losses from sanctions are compensated for: gaps in the federal budget are filled, and strategic enterprises and the military-industrial complex are funded.

The NWF is essentially the reserve budget of the Russian Federation. It is the same "money box" that is used exclusively in times of crisis.

The fund is filled with oil revenues. For example, if Russian companies sell oil at US£80 per barrel, and the budget provides for revenues of US£44 per barrel, then that US£44 will go to oil companies and the budget from each barrel of oil, and the rest of US£36 will go to the NWF.

In preparation for the war, Russia increased the amount of money in the fund from US£65 billion to US£182 billion (approximately 13.5 trillion roubles) between 2018 and 2022. And six months before the full-scale invasion, all of the NWF's assets were converted into gold, euros, yen and yuan.

To combat the effects of sanctions and finance the war, the Russian government spent 3 trillion roubles from the NWF in the last three months of 2022. According to the Russian Ministry of Finance, the fund currently holds assets worth 11.9 trillion roubles, of which 6.7 trillion roubles (US£87 billion) are liquid - that is, those that can be quickly converted into money. The KSE has estimated that these funds will be enough for the Kremlin to finance the war until the end of 2023.

If the Russian Federation finds additional sources of budget revenues and buyers for its energy resources, the NWF's funds will be enough for a longer period.

Ukraine does not have such reserves and supports its economy with Western loans and grants. The World Bank has estimated that more than US£400 billion will have to be raised additionally to compensate for infrastructure damage. The only way to be financially equal to the aggressor is to take away its frozen reserves in the West.

No one knows where the money is

In April 2023, the German news outlet Die Welt stated that after the war, the European Commission wanted to return the frozen reserves to the Russians - these reserves were worth more than US£300 billion in the G7 countries.

Therefore, it turns out that Russia, which started the war, will receive these funds to recover its economy, while Ukraine will be left at a broken trough with a pile of debt and destroyed cities. The Russians are unlikely to pay reparations willingly, so the only way to avoid this scenario is to seize their money and use it to compensate Ukraine. However, in the second year of the full-scale war, no one knows exactly where this US£300 billion is, let alone its seizure.

Politicians take information about the amount of this money from the reports of the Central Bank of the Russian Federation. This means that the data may not even be true. "When Ukraine takes out a loan from the International Monetary Fund (IMF), they send auditors to check our reserves.

In Russia, there have been no such audits for decades. No one has verified the reports submitted to the IMF and compared them with real assets, so we don't know exactly how much they have in reserves. We don't even know the exact methodology of how they count their assets," Lidiia Lisovska, an analyst at the Russian Assets as a Source of Recovery of the Ukrainian Economy project told Ekonomichna Pravda.

In order to have a constructive dialogue with Western partners about Russian money, Ukraine needs to know what accounts and countries Russian billions are in. However, no one discloses this information. "Hundreds of billions of Russian reserves are concentrated in the West.

Such sums cannot be just lying around. Presumably, such large sums of money are in government bonds. That is, the US, UK and Germany have sold their debt securities to Russia and their governments know the exact amounts.

At the same time, there are very few banks that intermediate in such large agreements, and it is not a problem for the state to identify them," Nataliia Shapoval said. Nevertheless, in Shapoval's opinion, if information about Russian assets becomes public, Ukraine and its partners will start diplomatic pressure and look for ways to get this money. The countries where Russians opened accounts to place their reserves are in no hurry to give this money away and are hiding information about it.

Difficulties of seizure

Western countries are used to living by the rules.

According to international rules, one country cannot simply take funds away from another. This protection of investments is called state immunity. It is due to transparency and adherence to these rules that the British pound, euro and US dollar are the leading currencies in which most countries in the world keep their reserves.

There is a risk that after the first seizure of Russian funds, the lion's share of investors will refuse to keep money in these currencies and will start looking for safer jurisdictions. For instance, China, which has US£3 trillion in reserves, will not be willing to invest in countries that can take the money away in the event of a conflict. "State immunity can be restricted legally, through the UN Security Council, citing Russia's violation of all possible norms of international law.

However, Russia is a permanent member of the Security Council and can block any such decision on its own," Iryna Mudra, Deputy Minister of Justice of Ukraine, explained to Ekonomichna Pravda.

In other words, international law does not work when it comes to holding a major nuclear weapon state, which is a member of the UN Security Council, accountable.

Ukraine has set out to reform international law and remove this contradiction. The idea is to create a mechanism that will authorise the seizing of the assets of aggressor countries without the approval of the Security Council. Here is an algorithm of how it will work.

First, the UN General Assembly votes by a majority to bring the aggressor state to justice. Such a resolution against Russia was approved on 14 November 2022. The countries that supported the resolution about making Russia pay reparations

Source: unian

Source: unian

Referring to this resolution, an international agreement will be created.

The countries that sign it will be obliged to find the aggressor's funds, seize it and send it to the state that suffered from the aggression. Funds will be distributed through a register of losses, which will take into account all material and human losses of each person, company and state as a whole. The Ministry of Justice will present the Ukrainian register of losses in the coming months.

In this way, Western countries will be able to legally limit Russia's state immunity by referring to a specific international agreement and UN General Assembly resolution. In the future, this mechanism will be available to any state that has suffered from aggression. The G7 countries will truly be ready to hold Russia accountable as soon as they sign the agreement.

How will the mechanism of collecting reparations work?

While negotiations are ongoing to formalise this mechanism, the EU is trying to find a compromise solution. For example, there is an idea to invest Russian money in Eurobonds at 2.6% per annum and give the profit to Ukraine.

Even if one assumes that the entire US£300 billion is invested in Eurobonds, Ukraine will only receive US£8 billion a year, or less than 2% of the amount needed for recovery. European countries will benefit more from this step, as they will bring this money into their budgets.

"These are political statements that have no legal basis.

Using Russian money, making a profit from it and sending it to Ukraine will have the same risks and difficulties as a regular seizure. So why not just make it a legal seizure?" asks Iryna Mudra. Lidiia Lisovska believes that Western partners must also have a financial interest in seizing the funds in order to convince them to do it.

European citizens already have an interest in this. "It is often difficult to explain to European and American taxpayers why they have to support Ukraine by paying out of their own pockets. Western governments can avoid these difficulties if they make the aggressor pay by taking away its money," Vladyslav Vlasiuk, advisor to the Office of the President of Ukraine, told Ekonomichna Pravda.

Oligarchs' money is being collected bit by bit

Another opportunity to receive compensation is the money of Russian oligarchs.

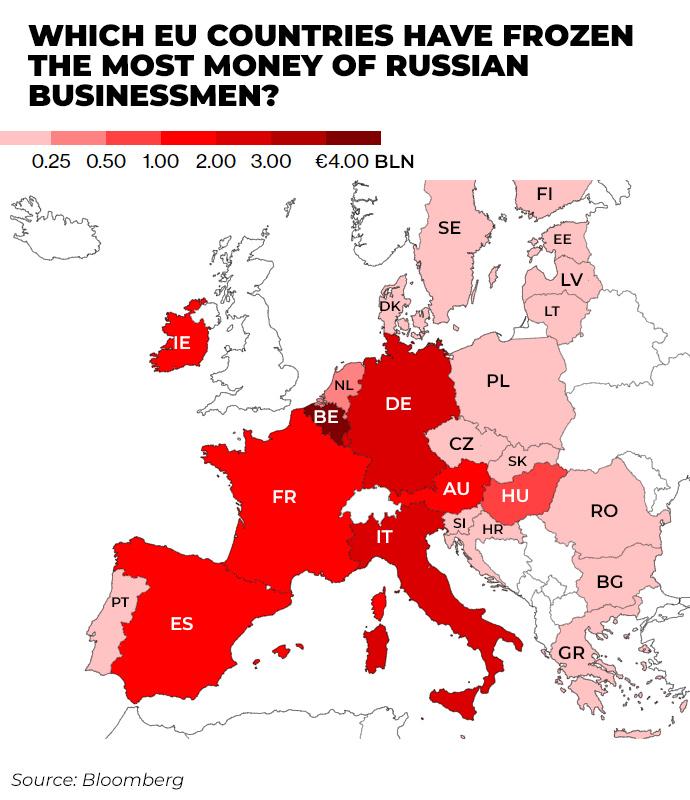

The West blocked the assets of Russian businessmen worth US£30 billion, but when it came to the seizure, the process began to slow down. As it turned out, these funds have to be collected bit by bit; moreover, there has to be a court's decision in every separate case.

The issue is that the Russians' money is planned to be seized not for the war against Ukraine, but for their personal financial crimes. Prosecutors are not always able to prove in court that a businessman violated sanctions or laundered money.

Therefore, oligarchs are able to protect their wealth in Western courts, taking advantage of their legal scrupulousness and ability to delay the process.

For instance, racing driver Nikita Mazepin, the son of Russian oligarch Dmitry Mazepin, has managed to get some of the sanctions lifted and continues to participate in competitions through the courts. He and his father own a villa in Italy worth US£105 million, which is under seizure.

Transparency International has noted that the EU should use alternative methods of seizure that do not require lengthy trials. In this case, much less evidence would be required.

Such alternative seizure is already used in Ukraine. In addition to standard criminal prosecution, there are two other working mechanisms for seizing Russian funds. The first is the seizure of state-owned Russian assets by a presidential decree approved by the National Security and Defence Council.

The second is the seizure of private assets through a statement by the Ministry of Justice and a shortened hearing in the High Anti-Corruption Court. Transparency International believes that in the first case, Russians can appeal the decision to higher authorities. In the second case, the procedure is more legitimate and involves a court, so it will be harder to appeal.

In the West, there are no shortened procedures for civil seizure yet. It is crucial for Ukraine to remain a leader in the process of seizing Russian assets and set an example for its allies to speed up the process. Yaroslav Sydorovych, the co-founder of the NGO National Interests Advocacy Network ANTS, has said that every Ukrainian who speaks a foreign language can help search for Russian assets.

To do this, you need to search the state registers of Western countries for any information about land plots, yachts, jets, cars and other property owned by Russians. Then, the National Agency on Corruption Prevention should be informed about the assets found. The agency will then move forward with its seizure.

The start of the economic frontline trials

The economic success of Western countries is based on the protection of property rights, which is considered an unquestionable value.

Now, in order to protect other values, human lives and global security, the property rights of criminals must be limited. Until countries develop a fast and efficient mechanism to seize the aggressor's money, the Russians will continue to use Western courts and state immunity to get away with their crimes. International law must also change, as it is unable to punish an aggressor if it is a member of the UN Security Council.

Ukrainians, who suffer the most from this contradiction, are among the leaders in reforming international rules. In 2023, it will become clear whether Western countries will have the political will to make Russia pay for its crimes, or whether this war will become a convenient precedent for impunity for other aggressive regimes. Speaking about the seizure of assets of the Russian Federation and its residents, one can recall a well-known proverb: "Never say never".

This is especially true given the transformation of many politicians' statements on weapons supply over the year: from categorical denial to substantial support and decisive actions.

The material was created within the framework of the ANTS project Russian Assets as a Source of Recovery of the Ukrainian Economy, implemented in cooperation with the National Democratic Institute (NDI) and the financial support of the National Endowment for Democracy (NED).

Bohdan Miroshnychenko for Economichna Pravda

Translation: Myroslava Zavadska